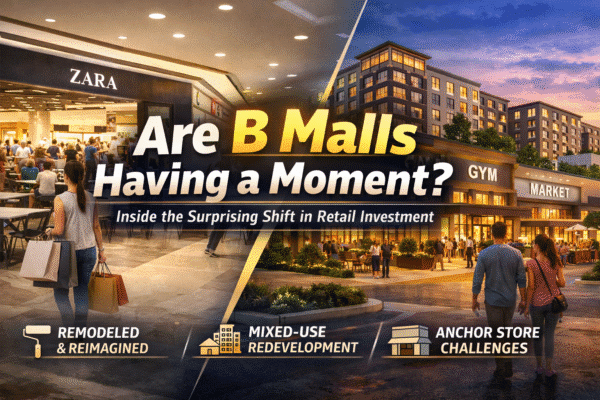

Are B Malls Having a Moment? Inside the Surprising Shift in Retail Investment

For years, the narrative surrounding American retail was a tale of two markets: the thriving “A” malls—luxury hubs with high foot traffic—and the “C” malls, destined for the wrecking ball. However, as we move through 2025, a new trend is emerging. Major players like Simon Property Group and Walmart are turning their gaze, and their capital, toward the often-overlooked “B” malls.

But what is driving this sudden interest in mid-tier shopping centers, and can these investments survive the continued decline of traditional department stores?

Defining the “B” Mall

To understand the investment shift, we first have to define the landscape. Traditionally, the retail industry grades malls based on sales productivity and occupancy:

-

A Malls: Top-tier destinations with robust sales (often exceeding $500–$800 per square foot) and premier tenants.

-

B Malls: Middling performers, typically generating around $300 per square foot with average occupancy and perhaps one or two anchor vacancies.

-

C Malls: Underperforming assets with high vacancy rates and deferred maintenance.

According to Green Street analysts, there are approximately 300 B malls currently operating in the U.S. While many were previously ignored, they are now becoming the frontline for strategic B mall redevelopment.

Why Now? The Scarcity of “Quality” Space

The primary driver for this revitalization isn’t just a love for nostalgia; it’s a lack of options. Despite high-profile store closures, the overall U.S. retail vacancy rate remains remarkably tight, hovering just over 4%.

Retailers looking to expand are finding that A malls are at capacity. This creates a “spillover effect” where landlords can elevate leasing efforts in B malls to capture brands that need a physical footprint but are locked out of premium centers. As David Simon, CEO of Simon Property Group, recently noted, the company is pivoting from an exclusive focus on “the A’s” to a significant growth program for B malls in 2025 and 2026.

Case Studies: From Pittsburgh to Long Island

Two major projects highlight the different paths B mall redevelopment can take:

1. The Cosmetic Refresh: Smith Haven Mall

Simon Property Group is starting its B-tier program at the Smith Haven Mall on Long Island. This approach focuses on the “facelift” model:

-

Updated flooring and interior fixtures.

-

New landscaping and refreshed signage.

-

An overhauled food court.

-

Attracting modern “mini-anchors” like Zara and Sur la Table.

2. The Mixed-Use Transformation: Monroeville Mall

Walmart’s approach in the Pittsburgh area is more radical. In partnership with Cypress Equities, they are looking to transform the Monroeville Mall into a mixed-use site. This vision integrates retail with residential, hospitality, and office spaces—effectively turning a shopping center into a neighborhood.

The Biggest Obstacle: The Anchor Dilemma

Despite the influx of cash, a major shadow remains: the department store. Historically, malls were built around the “anchor” model—get a Macy’s or a J.C. Penney, and the traffic will follow.

Today, department store foot traffic is down nearly a third compared to pre-pandemic levels. When these anchors leave, they leave behind “cavernous spaces” that are difficult and expensive to fill. While non-traditional anchors like medical offices, gyms, and grocery stores are moving in, experts warn that these tenants don’t always drive “cross-shopping” to the smaller boutiques in the mall.

The Risk vs. Reward Calculation

Investing in B malls is not for the faint of heart. Cap rates for B malls sit between 13% and 17%, significantly higher than the 5.5% seen in top-tier A malls. This indicates a much higher risk profile.

Success depends on:

-

Location: Is the mall in a growing suburban pocket?

-

Tenant Mix: Can the landlord attract “emerging” brands rather than just discount stores?

-

Capital Expenditures: Does the owner have the stomach for the massive cost of repositioning?

Conclusion: A New Chapter for the American Mall

The “B mall” is no longer just a placeholder between luxury and obsolescence. For savvy investors and retailers, these centers represent an opportunity to capture market share in a space-constrained environment. Whether through cosmetic updates or total mixed-use transformations, the goal remains the same: evolving to match how America shops today.