Automated Retail for NOI Growth: The Definitive Commercial Real Estate Asset Strategy

For commercial real estate (CRE) owners and asset managers, the pursuit of Net Operating Income (NOI) growth is the core driver of valuation. In the current competitive market, traditional methods of increasing NOI—raising base rents or drastically cutting essential operating expenses—are often constrained. The new, high-leverage strategy involves transforming passive or underutilized common areas into tech-enabled, full-service amenities that generate ancillary income while reducing management burden.

This is the power of Automated Retail for NOI Growth. It represents a fundamental shift in how property owners view their common spaces, turning them into predictable, 24/7 profit centers.

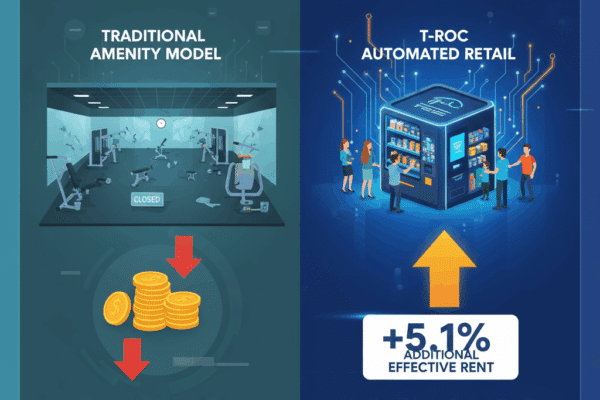

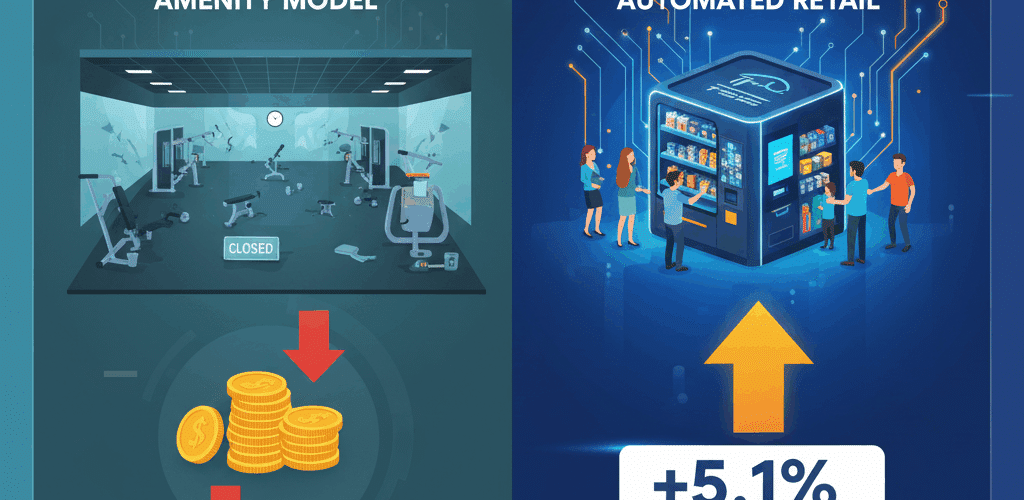

Why Traditional Amenities Fail the NOI Test

High-end amenities are proven to increase tenant satisfaction and retention, but they often present a significant financial challenge. Most desirable amenities—such as fitness centers, staffed cafes, or expansive tenant lounges—are cost centers that incur substantial up-front Capital Expenditures (CAPEX) and ongoing management costs.

The traditional amenity model typically follows this costly path:

-

High Upfront Cost: Major construction, build-outs, and system integration.

-

Management Burden: Hiring staff, inventory management, and maintenance oversight.

-

Expense Leakage: Increased utility, insurance, and labor costs classified as OpEx.

This cycle adds significant overhead, often diluting the positive impact on NOI and failing to maximize the asset’s true income potential.

The T-ROC Model: Automated Retail for NOI Growth

T-ROC’s Automate Retail system is a turnkey solution designed specifically to solve the NOI-vs-Amenity dilemma. It works by injecting three critical financial advantages directly into your property’s bottom line: Ancillary Revenue, Reduced CAPEX, and Minimal OpEx.

The Full-Service, No-CAPEX Promise

One of the greatest barriers to innovation in CRE is the risk and cost associated with capital investment. T-ROC addresses this directly with a fully-managed, No-CAPEX, Permit Lite model.

The system uses prefabricated formats and kits that allow for easy installation, dramatically reducing traditional construction costs and time. This approach ensures that a property’s financials remain healthy, avoiding debt financing or draining capital reserves for amenity build-out.

Transforming Passive Space into 5.1% Additional Effective Rent

The core of the T-ROC value proposition is the transformation of unused lobbies, hallways, or former storage areas into vibrant, high-traffic retail hubs. These hubs generate revenue through direct product sales, creating a new, reliable stream of ancillary income.

For CRE assets, this means a measurable, material increase in financial performance. By successfully optimizing passive space, owners have documented the ability to generate up to 5.1% in Additional Effective Rent. This uplift goes straight into your gross income, significantly boosting your Net Operating Income (NOI).

The Omnichannel Ecosystem: AI, AR, and Kiosks

The solution’s success is rooted in its cutting-edge technology, which blends the best of digital retail with physical convenience. This Digital & Physical Omnichannel Ecosystem ensures a superior tenant experience while maintaining operational efficiency.

AI-Driven Curation and Smart Inventory

The era of static, uncurated retail is over. T-ROC uses AI Data and Analytics to manage and optimize product selection in real-time. This is critical for keeping tenants satisfied.

-

Predictive Inventory: AI analyzes tenant purchasing habits, local demographics, and even time-of-day data to ensure the amenity is stocked with high-demand items, such as pre-made meals, frozen goods, or specialized products.

-

Reduced Shrinkage: Automated merchandise vending kiosks provide secure, trackable transactions, virtually eliminating the stockout and shrinkage issues common in traditional micro-markets.

Immersive Technology: Smart Mirrors and Digital Displays

The physical retail space is augmented by digital touchpoints that enhance the shopping journey. This digital layer includes:

-

Automated Merchandise Vending Kiosks: Secure, high-volume automated sales points.

-

Interactive Digital Displays: Used for promotions, brand engagement, and community announcements.

-

Smart Mirrors & Augmented Reality (AR): Offering virtual product try-ons and digital product offerings, extending the retail footprint beyond the physical shelf.

Direct Impact on Asset Valuation (Cap Rate)

By driving Ancillary Revenue, the T-ROC model directly increases the numerator (NOI) without increasing the denominator (Cap Rate, which reflects market risk). The result is a mechanical, predictable increase in the property’s total estimated valuation.

Furthermore, by offering a superior, professionally managed retail amenity, the property enhances its desirability and reduces tenant turnover risk. This improvement in tenant quality and retention can potentially lead investors to perceive the asset as lower risk, which may positively influence the Cap Rate applied by the market.